Will EU Stocks 50 Index have enough momentum to break support?

EU Stocks 50 Index is heading towards the support line of a Rising Wedge and could reach this point within the next 17 hours. It has tested this line numerous times in the past, and this time could be no different from the past, ending in a rebound instead of a breakout. If the breakout […]

Either a rebound or a breakout imminent on France 40 Index

France 40 Index is heading towards the resistance line of a Rising Wedge. If this movement continues, we expect the price of France 40 Index to test 6038.1200 within the next 9 hours. But don’t be so quick to trade, it has tested this line numerous times in the past, so this movement could be […]

Will Japan 225 Index have enough momentum to break resistance?

Japan 225 Index is heading towards the resistance line of a Channel Up and could reach this point within the next 17 hours. It has tested this line numerous times in the past, and this time could be no different from the past, ending in a rebound instead of a breakout. If the breakout doesn’t […]

Should we expect a bullish trend on EU Stocks 50 Index?

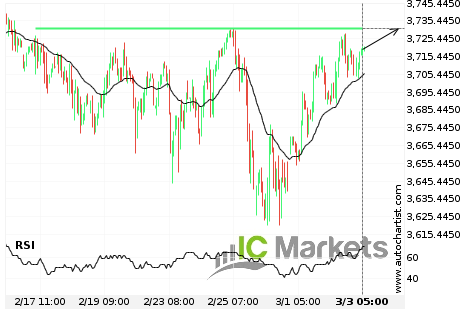

The breakout of EU Stocks 50 Index through the 3745.3601 price line is a breach of an important psychological price that is has tested numerous in the past. If this breakout persists, we expect the price of EU Stocks 50 Index to test 3805.7051 within the next 3 days. One should always be cautious before […]

Japan 225 Index approaching support of a Channel Down

Japan 225 Index is approaching the support line of a Channel Down. It has touched this line numerous times in the last 11 days. If it tests this line again, it should do so in the next 2 days.

Breach of important price line imminent by EU Stocks 50 Index

EU Stocks 50 Index is moving towards a line of 3730.8999 which it has tested numerous times in the past. We have seen it retrace from this positions in the past, so at this stage it isn’t clear whether it will breach this price or rebound as it did before. If EU Stocks 50 Index […]

Japan 225 Index is on its way down

Japan 225 Index has experienced an exceptionally large movement lower by 1.62% from 29,914 to 29,456 in the last 5 hours.

Japan 225 Index approaching important 30266.0000 price line

Japan 225 Index is approaching the resistance line of a Resistance. It has touched this line numerous times in the last 10 days. If it tests this line again, it should do so in the next 2 days.

Either a rebound or a breakout imminent on Italy 40 Index

Italy 40 Index is heading towards the support line of a Channel Down. If this movement continues, we expect the price of Italy 40 Index to test 22633.1000 within the next 3 days. But don’t be so quick to trade, it has tested this line numerous times in the past, so this movement could be […]

Japan 225 Index approaching important 30464.5000 price line

Japan 225 Index is approaching the resistance line of a Resistance. It has touched this line numerous times in the last 8 days. If it tests this line again, it should do so in the next 22 hours.